Why are Virtual Power Plant Models so Different Around the US?

A Primer on Value and Cost in Electricity Asset Ratemaking to Help Your Thinking about Virtual Power Plants

This primer is prepared for legislative staffers learning energy regulatory fundamentals. There are multiple complexities in energy regulation and ultimately legislative design, which benefit from simple explanations and integrated narratives bringing together concepts close to our daily experience (a utility energy bill) with those that are relatively arcane and yet form the "why" behind what we pay for electricity everywhere.

Cost of Service is the methodology used to assign value and cost of all conventional ways of producing, transporting and delivering electricity from a centralized source to a sink.

Cost of Service Methodology varies dramatically by state and market because different entities control different pieces of the electric system and services pie: this makes cost allocation methodology variable and difficult to compare across jurisdictions or states.

Virtual Power Plants have different value streams and different cost structures than conventional source-to-sink power plant and power delivery services. Rather than one central plant, it is many. Instead of power delivery through one networked highway, it is consumption behind hundreds of meters, and power flow across those hundreds of meters in the case of sharing electricity with the local grid.

Understanding how we pay for the traditional system today, why it is so discretionary, and how it winds up as a hodgepodge of charges on your electric bill, will help you understand why a Virtual Power Plant as an electric asset fits across multiple traditional value streams and why we see programs that assign dramatically different value propositions — and costs — for these assets and their services.

Why We Pay What We Pay for Electricity

Cost of Service Allocation is an exercise of great discretion. It is the manner in which we break down the costs of everything that a vertically integrated energy provider must recover in its rates in order to do the business of generating and delivering electric power (the plant, the poles and wires, the meters to a customer’s house, and everything in between).

These are the goals of cost allocation:

It is a deep field, and a wide one. It explains why your electric bill is a rolling series of charges and credits with associated line items and codes that correlate to masses of paper tariff documents available on a utility service provider website.

Cost of Service methodology is utilized in every state, in every market design whether deregulated or not: where different parties that are not a natural monopoly own a piece of the pie of producing and/or delivering electricity, there is a cost to do so, and those parties own those costs and will seek to recover them. In Texas, a competitive retailer will show you the costs on your power bill associated with (i) the utility’s poles and wires delivery charges, (ii) the utility’s share of load service capacity charges related to ERCOT maintaining the capacity and ancillary services needed to stabilize the grid and serve your demand, (iii) the commodity cost of the electrons themselves which the retailer purchased from the ERCOT wholesale market to deliver to you. Similarly, utility bills in markets that are part of ISOs/RTOs reflect charges from the grid operator and their own cost-of-service charges approved by their state regulator.

A market design is any system and services structure which creates the circumstances for all involved parties in that market to recover their costs for providing one or more of those systems or services. A vertically integrated utility model is a market design. A semi-deregulated model in which utilities own or contract power plants, provide the poles and wires and sell wholesale power, and certain customers but not others can buy retail power from a competitive energy provider, is also a market design. See examples.

As this chart shows, any type of energy service and infrastructure system, or market design (a vertical utility, an ISO with deregulated players and some utilities) needs to share the costs of providing its services.

The stakeholders in the relevant market will ask one or more regulators or governing bodies to approve the total compensation needed to deliver the products and associated services: this is the requirement of the service provider in terms of Revenue.

Revenue by design in a regulated monopoly context, includes the costs of the system managed by the monopoly and a profit share (return on equity, or ROE) that the regulated entity seeks to make on top of its costs to operate the system.

Ratepayers - you and me - fit into this model by paying for both the baseline costs to operate a system of services to send them electricity plus some profit (ROE) that the entity desires for that service in relation to its capital expense to provide the service. The ROE, along with the Return on Debt, is the component that together forms a Rate of Return.

The regulator’s job is to approve the prudency of the costs filed to operate and deliver the system of services, the profit that is sought on top of those costs for capital expenditure, the prudency of debt incurred, and so forth. Together, these factors make up the Revenue Requirement. In a simple formula , it looks like this:

Here is another way to undertand this formula. In this representation, “Expenses” are specified as including operations, maintenance, administrative, and general. Depreciation is also an expense and accounted for accordingly. Taxes are expenses of two kinds: income and non-income, netted with tax or other credits. The total Cost of Service, or Revenue Requirement, is the sum of all of these expenses, within which, the Rate of Return includes the profit percentage (ROE) that the utility entity can earn on top of its costs for capital expenses.

Cost Allocation Principles and Rate Design Lead to Your Electricity Bill

The primary purpose of a rate case is to review the cost studies performed across the various functions owned and operating by the filing entity, assess the fairness and legality of the cost allocation proposed as a result of those studies (including how they are functionalized and classified), allocate those costs to customer classes, and then design rates based on the costs to be recovered which become the tariffs or rate sheets of the filing entity/utility/service provider. The functions above are Transmission (T), Generation (G), Distribution (D) and Customer Services/Billing/Other (Other).

I. Functionalize (T G D Other)

II. Classify (Capacity or Demand, Energy or Average Demand, Customer-Related)

III. Allocate (Assign all costs to 100% of total cost, across rate classes)

Note: II. classifies costs for each functional category. It looks like this:

With a Revenue Requirement so established, the last step of a rate case (and often the shortest step - stuffed into the exercise at the last minute) is Rate Design.

The Rate Design phase results in the creation or modification of tariffs, which is the piece of the pie we are most familiar with as recipients of an energy bill:

On the other side of this exercise, in a ratemaking model, is the idea of value. In a rate case, the exercise to go through is essentially, does the value of the infrastructure and services that ratepayer money will be spent on, meet or exceed the costs of providing them? This question is difficult to answer in scientific, objective terms. Rate design is an art, not a science.

Transitioning from Traditional Rate Approaches: Virtual Power Plant Programs

To translate what you’ve learned above to the world of ascertaining Virtual Power Plant value (and thereafter cost), below is a helpful diagram. To create the program to compensate - or assign cost - to a virtual power plant based on its many values to the energy system and to individual customers housing these resiliency assets, we are essentially undergoing the same type of ratemaking exercise with a few modifications to reflect that a single asset type has multiple values. First there is an exercise of breaking out what types of Value(s) the VPP will provide: across Transmission, Generation, Distribution, Other (Community Benefits, Environmental Benefits, Resiliency in the Home).

Failed to render LaTeX expression — no expression found

Just as in conventional rate design, there are challenges to assigning cost and value in VPP design. These are exacerbated in market designs where different entities own different pieces of the energy system and services value chain. For example, a VPP that provides load reduction in ERCOT - Texas, is helping the transmission system operator (ERCOT) manage the costs of delivering peak power during high-priced periods, but there is no price signal to assess the value of the same assets engaged in this behavior on the local poles-and-wires system that is owned by local electric distribution utilities, not the transmission grid operator. This bifurcation in ownership and operation of the system makes it harder, for example, to make “proactive distribution system investments” that fully value the VPP’s benefits to both, as described below.

The Good News: regardless of existing regulatory structure, it is possible to deliver what is known as a complete, or near-complete, value stack for the VPP assets available to an energy system. Payments for value fundmentally reduce the cost to operate one or more components of the system, reduce capital cost to maintain the system, and provide community resiliency and clean energy benefits.

Virtual Power Plant value in most U.S. markets is not as sophisticated an integration into the buy-sell electricity system as, say, the ADER Pilot in Texas. Instead, the value of VPP is ascertained and compensated for in program design which occurs on a parallel path to traditional rate cases, seeking to reduce costs and increase value through VPP as a product that is an add-on to traditional electric services. For example, an energy demand response and efficiency program may be the venue to compensate a VPP at the outset, and the rates and benefits are merged into a broader cost of service rate case at a future date.

When implementing such a program, the regulator will need to determine the total value of the VPP program, as described above, and then compare it to the proposed costs - which typically include incentives for inviting participation and/or payments for participating in VPP events (reducing load, reducing capacity strain on the local system, exporting power, etc.) This exercise is called a “cost-effectiveness test”. In California, there is an avoided cost calculator developed to help regulators understand cost-effectiveness of VPP programs across all parts of the electric system and services: T, G, D, Other.

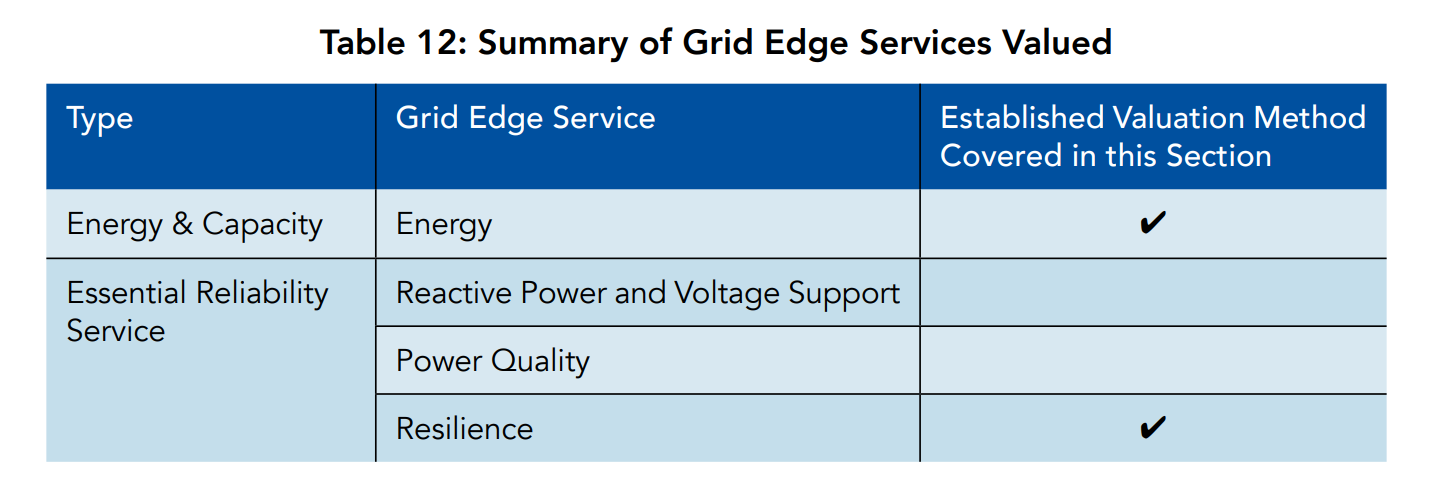

Below is a comprehensive list of the multiple potential values a VPP can provide simply in terms of engineering support to a functional, reliable electric grid and market (not including societal or consumer-facing values). Noting of course, that services look different based on which device is participating, an aggregation of many devices could provide many services. Batteries can perform sophisticated bulk power services and grid-edge services. Smart water heaters can do some sophisticated services (frequency following), and thermostats can support grid-edge load reduction (energy reduction to reduce bills).

Summary: Advocating for the Value Proposition from Dispatchable VPPs

It becomes the job of regulators, advocates, VPP providers, and hopefully local utilities, to advocate additionally for the non-energy benefits (societal, consumer-facing) of VPP. Those values are noted below.

Source for Above Diagrams: NARUC Report 2024.

Net benefits are ultimately calculated by a regulator in the program design phase (similar to a rate case, but through the creation of a program with an associated rate design limited to the program) by subtracting all VPP costs from the total ascertained VPP benefits. We are spared most of the jargon and weedy cost studies associated with traditional ratemaking, but retain most of the principles behind the exercise.

Ultimately, the goal of VPP program design is to create a runway for the utility to include the program in its Revenue Requirement as a fundamental asset just like other T, D, G, Other assets which have a cost and a justified value proposition. Advocates for VPP to be treated fairly as revenue-earning assets for the utility - commensurate with substantial benefits to their customers - will take actions like testifying in support of including VPP - related investments in Integrated Resource Plan proceedings. These are the longer-term plans that regulated utilities use - those that own G, T - to determine where and how they will procure their next tranche of electric generation. Creating competitive procurement of VPP in this process is the “end game” for ensuring VPP becomes a staple across the U.S.

Check out the testimony of Sonnen CEO Blake Richetta in Georgia’s 2024 Integrated Resource Plan proceeding. Georgia is a vertical utility market design: IRP 2023 Update Direct Testimony of Blake Richetta and Andrew Posner on behalf of the Georgia Coalition of Local Governments. This is an excellent primer on how a conventional utility can and should incorporate VPP into its asset procurement strategy to reduce rising components of ratepayer electric bills. Sonnen has already accomplished this in Utah.

— Arushi Sharma Frank

Terrific work, Arushi. Not that I understood it all, but enough to help me move up a rung on the VPP valuation knowledge ladder.