Gas + X: Explaining Hybrid Gas and Flex for Powering Everything

Flexible Demand and a Gas Pipeline Work Together to Solve Big Problems for Power

Gas economics look a little crazy these days. It is not unusual for me to find conversations on social platforms frequented by deep professionals, which confuse and muddle gas financial returns across utility or ISO-RTO footprints with those of unincorporated areas or competitive non-FERC areas like ERCOT. The reality is, new build fundamentals are a pendulum swing apart in the various “hot spot” data center growth markets.

Today’s piece posits Gas + X as a fundamental thesis to practical extension of the gas fleet lifespan, which holds a lot more promise than anything else for powering our nation’s time-sensitive abundance ambitions. - A.S.F.

In this Article:

I. The Grid Needs Gas. But Not Like Before

Data center and industrial electrification loads are here now, reshaping local power economics.

In the cases where system deliverability, not raw generation, is the choke point, the answer isn’t gas-only — it’s Gas + X.

II. What Gas + X Looks Like in the Wild

Middle River Power’s CAISO peaker + battery retrofits.

Google/I&M demand-side flexibility.

ERCOT’s Controllable Load Resources.

PJM’s FERC order correcting storage modeling.

RMI’s “Power Couples” concept.

PowerTransitions’ brownfield solar+storage at gas sites.

III. Why the Model Is a Hodgepodge in Progress

Market design differences: ERCOT, PJM, CAISO, regulated utility states.

Example: SCE’s hybrid peakers vs. LG&E/KU’s gas-only settlement.

IV. Financing Risk is Market-Specific

Financing in ERCOT merchant context: gas contract as anchor, BESS as optionality.

ERCOT Retail-choice leverage example: NRG’s 295 MW data center retail deal - announced on August 6 (Energy Choice Matters).

Regulated utility context: rate-basing hybrids framed as T&D deferral.

Impact on DSCR and credit risk.

The Grid Needs Gas. But Not Like Before.

The world isn’t done with gas. We’re just done pretending that it alone can carry the weight of what’s coming.

AI workloads, hyperscale buildouts, pumped-up electrification targets—these loads are already reshaping local power economics. Look at Northern Virginia’s “Data Center Alley,” where grid planners are actively delaying interconnections and issuing moratoriums, not from lack of generation, but from lack of deliverability. ERCOT, PJM, CAISO—they’re all buckling under queue congestion, load clustering, and a 20th-century planning apparatus. That’s quite the problem statement.

The answer, we posit, is Gas + X.

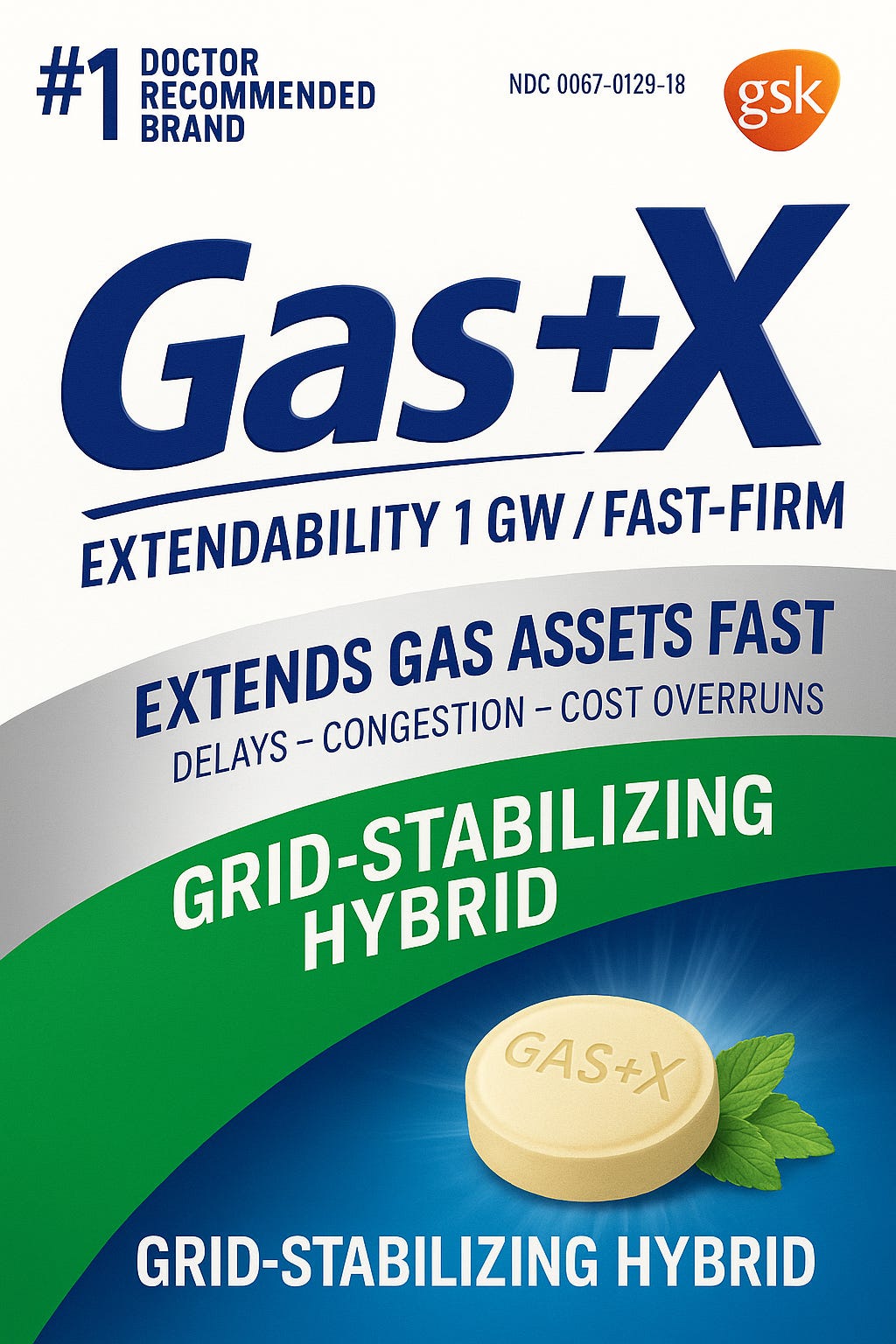

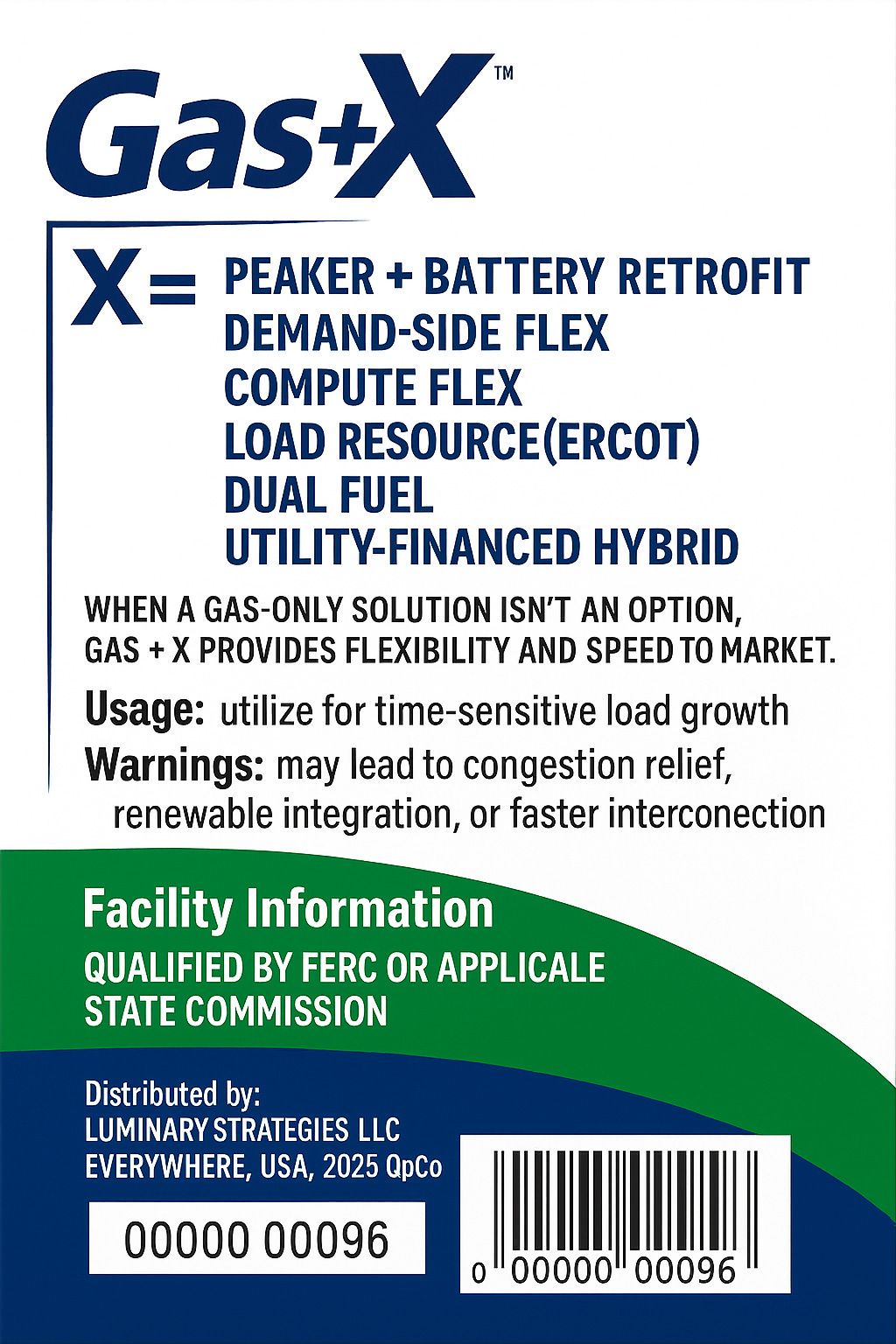

Enter apt but comic relief:

Gas + X is a hybrid strategy that pairs legacy (or new) gas generation assets with some form of flexibility-enabling asset—typically batteries, flexible compute, storage, or demand response. This is all together, shaping up to be the new model for grid stability in a disorderly energy buildout situation that has most of us tearing our hair out trying to keep up with regional differentiators. The strategy underscores just how flexible approaches from the demand-supply resource stack —rather than grid infrastructure buildouts alone—are becoming the speed-to-market solution for high-demand zones.

Examples of Flexibility Making its Way into Gas Generation Markets: