From Wildfires to Winter Storms: How California’s Crisis Sparked My Work Launching Texas’s Virtual Power Plant Revolution

How it all started and how we got where we are today: a review of public filings, narratives, and personal accounts from my time creating the framework in ERCOT which led to the ADER Pilot.

“While processes for demand-side participation have been longstanding in the ERCOT region, aggregated participation from distributed devices has never included a population of devices that, on an individual basis, can be net-injectors of electricity in times of scarcity or grid need, with committed performance equivalent to that expected of traditional generation resources dispatched by ERCOT. This is the distinction between current demand response and price response programs administered in the ERCOT region and the new market participation mechanisms being piloted in the ERCOT ADER Pilot Project. More simply, the ADER pilot pioneers in the ERCOT region the ability for controllable DERs at an aggregated location to participate in 5-minute dispatch.”

- Comments of Tesla, Inc., filed by Arushi Sharma Frank, former Tesla US Energy Markets Policy Lead & Senior Counsel, Texas PUC ADER Task Force Vice Chair, July 18, 2023

There are just a few topics in the universe of energy nerdism where I find myself uniquely situated to provide a true and complete anthology of events, some foreseeable and others not so much. Written for sharing with a lay audience, students, and energy policy professionals in state energy offices, advocacy organizations and government.

VPP Phase I: Winter Storm Uri, a new ERCOT CEO, and Competitive Spirit.

Some time in early May 2021, just a few months after Winter Storm Uri showed us how badly we needed to bring dispatchable megawatts to the Texas grid, I had a conversation with a good friend, who also happened to be the incoming CEO of ERCOT - Brad Jones. It was his first week on the job, and he absolutely made time for this conversation. Notable from our chat, even though the focal point of the conversation was how similar Texas is to Australia, (where Tesla’s gigantic and successful Powerwall VPP continued to grow), was his statement “I don’t like hearing that ISO-NE has done ANYTHING before us!”

That was Brad, reacting to my pointing out that the New England grid operator had already achieved a grid-integrated Virtual Power Plant aggregation with Green Mountain Power (GMP). GMP was utilizing Tesla Powerwall to participate in load frequency control services, or Regulation Service. This is a grid service that brought fine-tuned grid control from residential batteries to the constrained New England grid. The aggregation also participated in the New England capacity market, promising reliable, dispatchable megawatts at the same performance standard as power plants. And, the utility had founded this program years ago. Texas could have already had it too.

The competitive spirit certainly drives ERCOT - it’s the most competitive market in the country. And it drove this particular company I worked at. And it absolutely drove me. I did not need to hear more. It was off to the races: a timeline we should replicate everywhere - before a massive weather crisis invokes momentum for change.

ADER Phase II Preamble: California Wildfires Lead to Rapid Export Compensation for Battery VPP

In California within that year (2021), the state’s public utility commission had started changes to the Emergency Load Reduction Program that would for the first time, allow net injection from individual batteries in an aggregation to export power in concert and be paid for that export under the same terms as load reduction. [See, e.g., ELRP Landing Page, “Customers with distributed energy resources that can generate energy (e.g., behind-the-meter solar plus storage, electric vehicles, cogeneration, etc.) that have permission to export.”]. Note: Program has evolved further since, ELRP is replaced by DSGS. The life-altering wildfires of recent California summers - and now, in the dead of winter months - were part of the impetus to loosen up the program and get capacity on the grid to help the utilities’ distribution systems with these sorts of day-ahead conditions:

After RUC results reviewed: RUC is infeasible for one or more hours compared to the published Day-Ahead forecast. (Per the “RUC under-supply” column in the Day-Ahead System Summary report).

EEA Watch is being declared

Gas curtailments that reduce capacity awarded by the DAM

Ongoing grid issue (Fire, Natural Disaster) o Resource constraints/restrictions not known ahead of the DAM

Customers got officially compensated in summer peak season 2022, but they actually got unofficially compensated before that too in Summer 2021. Governor Newsom issued a July 30, 2021 emergency summer supply directive, which allowed for the first time net injection, or exports, from residential batteries to be paid to support the grid under the load curtailment program (ELRP). “That is generally not true of California policy frameworks that govern VPPs, including for resource adequacy need…This is one thing about ELRP that is a step in the right direction,” stated Kate Unger, a California trade association rep to Utility Dive on the matter.

The formal program for 2022 onwards thus came out of a state weather emergency which forced the state government to rethink its position on grid exports from residential batteries and act quickly.

VPP Phase II: Replicate Emergency Needs in Texas for Rapid DER Advancement

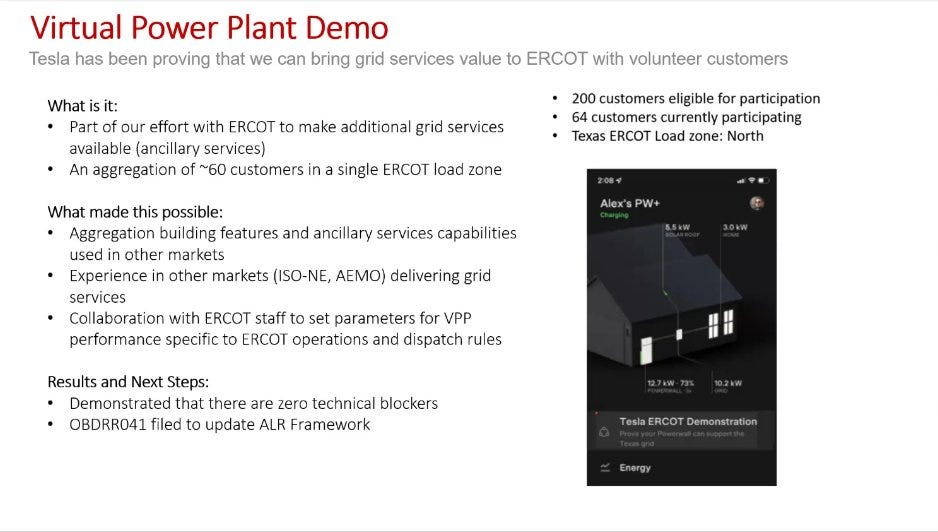

Tesla identified the equivalent of an “ELRP” model in Texas - the Aggregated Load Resource Framework (ALR). After asking customers to volunteer their systems’ capacity for some amazing VPP testing, Tesla announced the results of that testing at a public ERCOT workshop with several companies in attendance, who all put forward a solid case to quickly modify the ALR Framework to effectuate the same outcome to compensate grid injection. This was the first public gathering where Tesla announced its advocacy proposals, along with allies at other VPP and retail energy providers, in Texas. Its conception, delivery, and what happened next, is a months-long endeavor I embarked on after Storm Uri with the support of Brad Jones. It precedes the constitution of the ADER task force by several months:

Importantly, California ELRP was distinguished from the ERCOT’s ALR Framework in one important way: ELRP had already been an active program for small residential loads to aggregate and get paid for load reduction behind the meter. ERCOT’s framework for the same - small <1 MW loads, had never been utilized but was also more sophisticated in its entry requirements - being tied to telemetry requirements to participate in non-spinning reserves so that ERCOT could pay for the capacity day-ahead and deploy load reduction in the 5-minute market for events lasting up to four hours. The ALR Framework had consequently been on a shelf for nine years, years in which small batteries did not exist in any number to make a case for ALR qualification. So, through a product of various circumstances, Tesla was the first entity in nearly a decade to attempt to bring it to life. And it was of course nonsensical in the aftermath of Uri, to suggest that batteries only be paid for half of their value (load reduction at a premise) and not the other half (dispatchable exports while home needs are served).

The entirety of the test demo and subsequent ERCOT VPP workshop, hosted by Tesla, was handily covered in several trade press and blog articles:

Thereafter, Tesla filed a request with ERCOT to update the ALR Framework - citing the need for urgent consideration of the fact that Powerwall alone in the state could help the grid if customers were motivated to share their energy in a VPP program.

Here’s where it got tricky. Utilities and ERCOT both reacted strongly to the idea that residential exports could get compensated in a load reduction framework. Well, there were not any wildfires chomping down wealthy homes in Texas, when I filed the OBDRR. Instead, the market was in a reactionary shock period: why and how were so many Powerwall available to sell power, how come no one else was pushing this, why is Tesla ignoring the utilities?

That’s where this gets even more fun. If you want a sense of how fun, you can read Russell Gold’s article in the Texas Monthly - rather ironically titled given current tidings, it is the only major press piece in which I am mentioned directly along with my former boss, Mr. Elon Musk. Elon Musk Came to Texas to End the Oil Age - Texas Monthly

The thing is, in Texas, distribution utilities manage the distributed grid. The high-voltage grid sends and delivers its power through the auspices of ERCOT, the centralized grid operator for the market which then delivers to utility-owned and operated distribution networks. Unlike, say, in Australia, or, say, Florida Power and Light, different entities in ERCOT own different parts of the physical infrastructure of the grid, and know different things about various parts of the grid (and no one knows perfectly about all of it). That is what the challenge came down to, and why our proposal to replicate ELRP principles in Texas was challenged. In California, the large load-serving entities are the same entity as the poles and wires utilities, and the same entities that largely procure and own/operate generation, or contract for it. They also are integrated as Load-Serving entities with the California Grid Operator - the CAISO. That’s not true in Texas. Visibility and accountability are split. [Learn about that in one of my earliest market design teaching posts on Energy Central]. In Texas, unless you are in a municipally or cooperative vertically regulated entity, or you live in El Paso Electric’s or Entergy’s service area, your grid providers are manifold. ERCOT and the load-serving entities, i.e., the competitive retail energy providers, talk to each other about real-time energy dispatch through a network of shared systems. ERCOT and the poles-and-wires utilities - which neither serve commodity load/schedule it, nor do they own and operate generation - don’t talk to one another the same way. The market, as a result of the close-to-perfect competition in deregulation we have in Texas, is also multiple layers of complexity in relationships between who governs and manages physical infrastructure, and who governs and manages the flow of power across the high voltage and low voltage systems.

So, the OBDRR proposal did not work. The primary reasoning for this, was the fractured nature of the utility-ERCOT-load serving relationship, and it is well described in the utilities’ joint filing opposing the OBDRR:

Oncor, AEP, CNP, TNMP and STEC (“Joint Transmission and/or Distribution Service Providers (TDSPs)”) submit these comments to express concerns with Tesla’s proposal for establishing an Aggregate Load Resource (ALR) in the ERCOT market. The Other Binding Document (OBD) entitled “Requirements for Aggregate Load Resource Participation in the ERCOT Markets” initially developed nearly ten years ago does not appropriately address the operating characteristics of the ALR proposed by Tesla. As initially conceived, the OBD addressed ALR participation as Demand response, whereas Tesla’s proposed ALR would actually inject energy into the electric Distribution System, potentially presenting system management issues for Distribution System operators. This energy injection behavior poses several concerns:

· Distribution Service Providers (DSPs) review and certify Customer-owned Distributed Generation (DG) interconnections to the Distribution System. To the extent that battery systems included in the proposed ALR were not studied nor certified by the interconnecting DSP to operate in the manner being proposed, Customers would need to notify the DSP of any changes in operations pursuant to applicable Interconnection Agreements. Coordination with the interconnecting DSP(s) is a necessary step in the creation of ALRs to ensure compliance with Interconnection Agreement provisions, or modification of such provisions if necessary.

· DSPs have not evaluated the impacts of residential battery systems simultaneously injecting into the Distribution System during an Ancillary Service deployment. Customer location matters greatly, and the injection behavior could impact power quality for other Customers served by the same or proximate distribution facilities. The interconnecting DSPs must be afforded the opportunity to evaluate impacts of the ALR behavior to their Distribution System facilities and other Customers the DSP serves. This should occur through an interconnection process similar to other Resources, beginning with an initial application, a technical study to evaluate system impacts and potential facility upgrades, commissioning and testing with the interconnecting DSP and ERCOT, tracking and modeling, and a contractual agreement approving the operation and requiring a notification of any operational changes.

· Several market rules have recently been established for distribution-connected Ancillary Service providers, specifically Distribution Generation Resources (DGRs) and Distribution Energy Storage Resources (DESRs). A review process for these Resource types led to several Protocol, Operating Guide, and Planning Guide revisions. Any new Ancillary Services providers, such as the ALRs being proposed in Other Binding Document Revision Request (OBDRR) 041, need to be evaluated in similar fashion to identify operational, planning and market impacts prior to developing new market rules. Such impacts may include, but not be limited to, the implications of ALR Customers connected to the distribution system via feeders included in a DSP’s Manual Load Shed or Under-Frequency Load Shed programs.

· Since Real-Time system conditions often differ from planning studies, the DSPs will also need the ability to preempt any ALR wholesale market deployment instruction in the event the injection to the grid, either alone or in combination with others, creates a reliability issue on the Distribution System.

· Finally, since these ALRs will be injecting power into the grid and then subsequently into the transmission system, it is appropriate to limit aggregations to an individual transmission Point of Interconnection (POI). Constraints can happen within the large areas of the grid defined by Load Zones and, therefore, it is critical that ERCOT takes the differing impacts of these resources into account in their clearing and deployments. It is the Joint TDSPs’ understanding that this nodal treatment of such resources parallels the treatment provided by many of the RTO’s compliance plans with FERC Order 2222.

Comments of Oncor Electric Delivery Company LLC; American Electric Power Service Corporation (AEP), CenterPoint Energy Houston Electric, LLC (CNP); Texas-New Mexico Power Company; South Texas Electric Coop., Inc. (STEC) (“Joint Transmission and/or Distribution Service Providers (TDSPs)”).

Web Link to all OBDRR Comments: https://www.ercot.com/mktrules/issues/OBDRR041#keydocs

So, that’s how I found myself making a middle-of-the-day filing from a hotel room in Austin, advising the PUC after a spur-of-the-moment chat earlier that day, drafting inter-hour comments to support a sensible pilot administered by the PUC instead of a change to the ALR framework. My goal was to ensure we protected the mission, and made sure that everyone in the utility stakeholder community felt more secure about studying the impacts of VPP exports on their mini-grids, and on the ERCOT -managed central grid. No one at the Commission had told me what would happen at this open meeting where the Commissioners pushed me on the need for a solution. Rather, in real-time at that open meeting, I heard the details from the dais-led discussion, of proposals that various other parties (utilities in particular) had put forward. But, I work fast, think fast, and care too much about the outcome to let that bother me. So with the surprises digested, in my hotel room, right after the meeting, this is what I wrote and immediately filed- and yes, I was still wearing my LFDECARB shirt from that morning:

Supplemental Comments of Tesla, Inc. response to PUC Texas Open Meeting discussions on June 16, 2022. [Search PUC Texas Project 51603 for more - this is where all the work happened before the ADER Task Force was constituted].

One important win that I can vouch for, which no one else will ever talk about, is that at that open meeting, there was a push suggested in the discussion (I don’t know who it came from) to make the pilot limited to NOIEs - as if, excluding the entire retail competitive market from being able to deliver VPP services to millions of Texans was a good idea. It was not, and I said so. Loudly, and clearly. And I won. The ADER pilot was scoped for the entire competitive market, and the NOIEs. And today, both are participating. Here’s the excerpt of an argument written from the JW Marriott:

Excerpt from Tesla Policy Lead Filing, June 16, 2022 - Available at https://interchange.puc.texas.gov/Documents/51603_65_1216243.PDF

The weeks that followed were filled with news articles. Many of them, from Tesla customers and fans who just did an incredible job helping me personally in a space that felt like a lonely vacuum. There were also retail energy provider CEOs and policy directors, and a great consultant I worked with, Eric Goff, who pushed me to get deep into ensuring the success of an ADER pilot project.

A lot of the subsequent work, that resulted in the constitution of the ADER Task Force, has been covered in my other posts and in news stories since. But one anecdote I will tell you about, also something no one else knows, is how relieving and supportive it was for me to suddenly get a LinkedIn message from an executive at CenterPoint, Jason Ryan, one day after the fateful open meeting. On June 17, 2022, Jason wrote, “Good to meet you briefly yesterday. If you'd like to discuss a pilot in Houston, please let me know! cheers. jmr”.

Jason then became the formidable ally I needed to make DER grid integration a reality in Texas markets. In our early days putting the task force charter recommendations together, we collaborated constantly, and made the experience fun and supportive of each other as dedicated professionals looking for solutions above all else. There were times, when he and I led task force meetings, where we wore matching suits, drank matching diet cokes, and generally tag-teamed the most gloriously productive volunteer regulatory effort the state has ever seen. The federal government took notice, and showed up in our back yard at the Mitchell Foundation in Austin to figure out how we did it. Pretty much two things, we told them: committed subject matter experts, utility leaders, collaborative regulator & grid operator working together - and transparent, clear public process.

Pictured below: DOE’s Visit to Austin. Note Pablo Vegas had already assumed ERCOT’s leadership at this point and is pictured below with DOE Secretary Jennifer Granholm. My colleague Brad succumbed to cancer on November 8, 2023, and was interim CEO of ERCOT through Nov. 1, 2022. A scholarship fund is set up in his name, viewable here.

In the early days of the task force, the two of us (Jason is still Chair, I am now an independent advisor on the task force, but started as Vice Chair while at Tesla) and a DOE Fellow with Commissioner Will McAdams (Tiffany Wu), and VA Stephens, staff to Commissioner Jimmy Glotfelty: a little Avengers team came together to create a monumental shift in the public’s perception of the speed and success rate of stakeholder-led, collaborative market reforms. The assembly thereafter of a task force of 20 dedicated volunteers who built consensus for the pilot rollout, was critical to our success.

What we accomplished in that first year, and then in the subsequent anniversary year, is well documented in Tesla’s public filings:

ADER 1 Year Reviews: https://interchange.puc.texas.gov/Documents/53911_52_1311452.PDF

https://interchange.puc.texas.gov/Documents/53911_55_1331785.PDF

I hope you’ll really read these if you’re into figuring out grid-integrated VPP anywhere in the world. If you read news articles talking about “slow progress” and that “interoperability” is the largest barrier to the pilot, please stop reading that news. There are 12 technical advancements ERCOT accomplished along with market participants who actually provide this product, within a year, irrespective of how much participation there was in the first year. The advancements in technical know-how, market confidence, and commercial agreements relying on interoperability standards, are tremendous. Quotes from spokespersons who do not know this material, and refuse to learn it, will continue to hyperfocus on second order problems. The first order ones - does it work, can we measure it, can we pay customers, can it scale - we solved through the work of the task force, in one year flat. Compare that to what is happening around the country with Order 2222 implementation speeds and have a good think.

Now, the ADER Task Force is working with ERCOT to kick open the doors on growing the program in some fascinating, critical ways. I spoke to Utility Dive about it quite recently, and I’m very optimistic that Texas’ success in this space will barrel forward in the new year.

— Arushi Sharma Frank

Thanks for all you do! I love this statement in the Texas Monthly article - Arushi Sharma Frank, Tesla’s policy head for U.S. energy markets, explained this result to the Texas Public Utility Commission in June. She wore a black T-shirt that read “LFDECARB,” which stands for “Let’s F—ing Decarbonize.”

“Show me the incentives and I’ll tell you the outcomes.” Charles Munger