Batteries, Utilities, Cost-Shifts: Understand the Dynamics, Logic, and Need for Grid Policy Transformation in New Orleans

Alliance for Affordable Energy and Together New Orleans have proposed a Distributed Energy Resource Program (DERP) for the City of New Orleans - Let's Talk Utility Arguments and Cost Shifts.

Investing now in a smarter, more flexible distribution grid is not a "cost shift"—it is a necessary correction for the historical cost shift utilities have long imposed: inefficient, ballooning capital expenditures that have failed to deliver what ratepayers actually want—fewer outage minutes, faster restoration periods, cleaner energy, and affordable electricity bills.

What is the DERP Proposal?

See: New Orleans City Council Docket UD-24-02

A comprehensive program proposed by Together New Orleans (TNO) and the Alliance for Affordable Energy (AAE).

Aims to expand distributed energy resources (DERs) in New Orleans by supporting solar-plus-battery installations.

Designed to create a citywide Virtual Power Plant (VPP) by linking hundreds of customer-sited battery systems.

Leverages settlement funds (not new ratepayer charges) for upfront battery incentives.

Requires participants to enroll in demand response programs, ensuring active grid support.

Key Features of the Proposal

Program Timeline and Structure:

Initial 3-Year Period (Phase 1):

Targeted Enrollments:

1,500 residential customers

500 commercial/institutional customers

Annual Enrollment Goals:

Roughly 500 residential and 150-170 commercial sites per year.

Transition to Tariff: After initial period, the program would evolve into a permanent "pay-for-performance" demand response tariff.

Eligible Customers:

Residential homeowners with rooftop solar or planning to install.

Small commercial businesses.

Critical community facilities (e.g., schools, health centers, shelters).

Incentives and Funding:

Upfront incentives for battery purchase and installation.

Funded through existing settlement funds (e.g., SERI credits).

Supplemental incentives linked to performance in demand response events.

Grid Benefits:

Supports distribution feeder reliability.

Provides dispatchable energy during peak demand or grid emergencies.

Reduces outage minutes and speeds restoration.

Offsets need for expensive centralized generation and transmission upgrades.

Implementation Details:

Participants must:

Agree to DERMS (Distributed Energy Resource Management System) enrollment.

Allow dispatch of their batteries up to a set number of times per year.

Meet equipment standards (e.g., smart inverters, performance certifications).

Long-Term Vision:

Transition from reliance on centralized assets to a decentralized, resilient, customer-participating grid.

Create permanent market structures for distributed batteries to provide capacity, ancillary services, and grid support.

Pictured Above: Excerpt from Filing of Together New Orleans & Alliance for Affordable Energy - December 2024 in response to Resolution and Order R-24-624 (Docket No. UD-24-02)

Breaking Down Entergy New Orleans’ Position (Cost Shifting)

“The DERP Proposal seeks to expand the number of participants in ENO’s current residential BESS program by incentivizing up to 1,500 residential and 500 commercial/institutional sites over a three-year period. However, the DERP Proposal would increase the size of ENO’s behind-the-meter (BTM) battery fleet at significant cost to ENO’s customers and without sufficient demonstration that these expenditures would be offset by corresponding benefits. ENO has previously submitted analysis to the Council estimating a nominal $457.6 million cost shift to non-participating customers from existing NEM and community solar programs over the period 2025–2044. The Company is concerned that expanding DER participation through the DERP as proposed would exacerbate these cost shifts if not carefully structured and implemented.” — Entergy New Orleans, Docket No. UD-24-02

In this filing, Entergy New Orleans warns that expanding access to rooftop solar and batteries under the AAE/TNO Distributed Energy Resource Program (DERP) could worsen a projected $457 million "cost shift"—one they estimate across the next twenty years. Yet their filing conveniently ignores that the DERP – adding batteries to existing solar systems and new solar-battery systems – is specifically designed to eliminate exactly these concerns by coupling rooftop solar with battery storage, demand response obligations, and virtual power plant (VPP) enrollment—transforming passive solar customers into active, grid-supporting assets.

Entergy New Orleans’ cost shift claim is not just exaggerated — it is prospective. The $457.6 million figure they cite covers a speculative 20-year period stretching to 2044. It assumes a static policy environment where nothing is done to correct the supposed “shift”—an environment where solar adoption continues to grow but no batteries are deployed alongside it, no demand response strategies are implemented, and no grid modernization occurs. It also completely ignores the critical fact that if batteries were paired with most or all Net Energy Metering (NEM) systems—as proposed by the DERP—there would be no cost shift to speak of.

The "cost shift" narrative is not only half-baked — it redirects attention away from the systemic root problems we need to crush around the country as we hear talk of rising electric bills and know that downward pressure on utility cost recovery will come from somewhere: systemic utility inefficiencies are a cost shift onto the very customers who pay for every decision that has led to rising distribution and transmission costs nationwide while wholesale power prices themselves have remained relatively stable. In a proposal like the DERP filed by AAE and TNO, where customers are putting private market dollars on the table - it is unseemly and illogical for a utility operator and its regulator not to take the deal. Market-supported, battery-enabled VPP programs eliminate the solar cost shift specter for concerned utility operators and arrest the systemic cost shifts that have led to rising electricity bills.

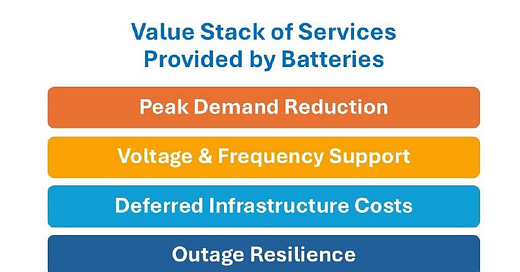

Batteries turn uncontrolled rooftop exports into dispatchable grid assets. They absorb surplus solar energy during low-demand periods and discharge when the grid needs it most. They flatten feeder loads, help maintain voltage, and deliver fast frequency response. With batteries participating in a citywide virtual power plant (VPP), NEM customers shift from being seen as “avoiding” costs to actively offsetting system costs. The very problem Entergy projects over the next two decades could be solved now—at a fraction of the cost—by implementing the DERP, not by resisting it.

Let’s learn a bit about this issue.

Entergy New Orleans' March 2025 filing in Docket UD-24-02 opposes the AAE/TNO Distributed Energy Resources Proposal (DERP), raising the familiar argument that rooftop solar and batteries could cause a "cost shift" to non-participating ratepayers. Ironically, while warning of theoretical future cost shifts, the utility simultaneously acknowledges that the DERP would support up to 1,500 residential customers, and up to 500 institutional or commercial customers, installing batteries over the next three years. Entergy’s own Demand Response (DR) Battery Energy Storage System (BESS) pilot, operated under the Energy Smart program and funded by all ratepayers, currently enrolls just 94 residential customers and two commercial sites—an enrollment rate so low that it cannot meaningfully provide grid services, offset generation costs, or improve resilience at the community or feeder level.

When we think about the classic “cost shift” argument against rooftop solar—a favorite of regulated utilities including Entergy New Orleans in their March 2025 filing opposing rapid expansion of the EnergySmart-derived DR BESS pilot program—the argument collapses under even basic mathematical scrutiny. A regulator in a grid area like New Orleans should be far more concerned with the utility’s own cost shifts.

For starters, the utility funds the DR BESS pilot from all ratepayers today, but only 94 homes and 2 commercial sites are enrolled (Entergy New Orleans, LLC, Comments of Entergy New Orleans, LLC, Docket No. UD-24-02, at 2 (Mar. 14, 2025). The program is so small, it cannot possibly hit any of the value streams we associate with shared ratepayer benefits: community-wide resilience access or the value of residential concentrations that can strengthen distribution grid resilience at a feeder level. And certainly at this size, the utility cannot manifest a dispatchable asset of any size to offset more expensive capacity in its generation/PPA stack, nor can it rely on the concentration of distributed devices to help manage outage risk conditions on its system or support its restoration efforts by helping it prioritize scarce resources to neighborhoods and feeders that do not have backed up homes.

The conventional (pre-DER) utility model channels all ratepayer dollars into a one-way, utility-owned grid—locking ratepayers into centralized infrastructure investments that create single points of failure. This, too, is a cost shift: one already happening. Every downed transformer on a single feeder is paid for not just by customers on that feeder, but by the entire rate base. Every new pole, wire, substation upgrade, or centralized plant—whether or not it benefits an individual customer—is paid for collectively.

The "cost shift" narrative against solar is a red herring in this proceeding - and arguably, always, in cost-plus utility regulation models. All poles-and-wires investments are socialized. All utility program funds are collected from ratepayers and spent across the service territory - find me a record of which pole and wire truck roll benefited which exact meter?! For those utilities that own generation or PPA risk, all power plants backing load-serving obligations, and fees to carry that power are financed with ratepayer-backed capital, even when they fail, underperform, or serve only a privileged fraction of customers - the ones who may benefit from upgraded feeder-level infrastructure (reinforced areas of the system, three-phase transformers), better vegetation management, better construction, or sheer luck in a storm.

We are entering a period, thankfully, where battery energy storage systems (BESS) are giving distributed rooftop solar new value as an active grid asset. Smart investment strategies—combining installer incentives, federal support, and targeted ratepayer funding—can transform solar from a perceived "burden" into an integral part of virtual power plants that deliver measurable system benefits. Enabling dispatchable two-way power flows motivates smarter investment in maintaining and modernizing the distribution grid, and actually increases participation across the rate base in sharing the costs of keeping the system reliable—not exempting distributed energy participants from grid policies or cost responsibility. Batteries enrolled in virtual power plants are not only available during emergencies; they also provide grid services on ordinary "blue sky" days, earning payments for capacity, load shifting, and ancillary services that reduce system costs for everyone. Far from abandoning the grid, distributed solar and battery owners strengthen it, becoming active contributors to grid stability, reliability, and affordability. In doing so, they help reverse the very cost shift utilities claim to fear, by turning passive meters into revenue-generating, grid-supporting assets. Doing so with market-based support as proposed in the AAE/TNO DERP – a combination of installer incentives (energy service partner contracts, third party agreements), federal or state program dollars, and ratepayer monies smartly allocated to up-front and performance incentives in a VPP model – immediately catapults the value of every ratepayer dollar spent, and monetizes rooftop solar and becomes the fix for all of the legacy and current complaints utilities have voiced.

The conventional “solar shifts costs” argument is on its death knell with the obvious evolution of net energy metering programs into battery programs. Adding batteries to solar rooftops immediately turns what some may consider a stranded asset to the utility grid, into an active asset.

A Note on Cost-Shifts and California

Discussion Note: Recent happenings in California are challenging the solar-only cost shift argument: scholars who have examined the real reasons for rising electricity prices in places like California have asserted that rooftop solar is not the culprit. As Ahmad Faruqui, a nationally recognized economist and grid expert, points out, California’s residential rates have been substantially higher than the U.S. average since 1979, long before rooftop solar adoption. The true drivers noted in California are inflated utility overhead, managerial inefficiencies, excessive executive compensation, and bloated transmission costs — not the modest growth of customer-sited generation. Along with eleven other experts including a former FERC Chairman and the former Vice President of the regulated utilities’ research organization EPRI, he filed a letter with Governor Newsom explaining as much in December 2024. The experts on that letter:

· Ahmad Faruqui, Economist-at-Large, former Principal, The Brattle Group

· Clark Gellings, former Vice President, Electric Power Research Institute

· Mark Z Jacobson, Professor, Civil & Environmental Engineering, Stanford University

· Daniel M Kammen, Professor, University of California, Berkeley and Coordinating Lead Author, Intergovernmental Panel on Climate Change

· Jim Lazar, Author, Electricity Regulation in the US: A Guide and formerly Senior Advisor, Regulatory Assistance Project

· Ronnie Lipschutz, President, Sustainable Systems Research Foundation and Emeritus Professor of Politics, University of California, Santa Cruz

· Bruce Mountain, Professor and Director of Victoria Energy Policy Centre at Victoria University, Australia

· Dustin Mulvaney, Professor, Environmental studies, San Jose State University

· Karl Rabago, Rabago Energy, LLC and former Commissioner, Public Utility Commission of Texas

· Karl Stahlkopf, CEO and Partner at SPS Energy & Finance, and former Senior Vice President, Hawaiian Electric and President, EPRI Solutions and Vice President, Electric Power Research Institute

· Jon Wellinghoff, CEO, Grid Policy, Inc. and former Chairman of the Federal Energy Regulatory Commission

· Greg Wikler, Clean Energy Professional and former Executive Director for the California Efficiency and Demand Management Council

When Solar Becomes a Problem - And Why We are Eons Ahead of that Problem with Battery Deployments

Perhaps it is time for the New Orleans regulator to ask for similar information. Blaming solar customers for rate increases is a self-serving distraction from the structural inefficiencies embedded in the utility model. Worse, it delays and undermines the very distributed energy solutions—including solar-plus-storage, home electrification, and grid-edge flexibility—that are critical for building an affordable, resilient, and decarbonized energy future.

For those familiar with utility narratives in other states and countries, the importance of recognizing feeder-level penetration rates and the operational changes required for a solar-heavy grid cannot be overstated. Australia, for example, sources over 30% of its residential electricity from rooftop solar, while rooftop solar provides over 11% of total electricity supply nationally, far surpassing the penetration seen in the United States. In leading U.S. states, rooftop solar adoption is rising but remains modest: California tops the list with about 10% of households having installed rooftop solar, followed by Nevada (approximately 7%), Arizona (approximately 6%), and Hawaii (approximately 5%). Nationally, only about 5% of single-unit U.S. homes had rooftop solar installed as of 2023.

Australia’s experience shows that as solar adoption increases to these dramatic levels, utilities must then fundamentally change how they operate distribution networks. Integrated Distribution System Planning (IDSP)—as outlined by Australian utilities in a 2024 study—demonstrates that intelligently managed low-voltage grids can save billions in system costs while enabling high levels of distributed energy resource (DER) integration. Key strategies include motivating battery adoption to mitigate midday "duck curve" effects and manage low-load days with high solar exports, deploying or enforcing smart inverter standards for voltage and reactive power control (Volt/VAR optimization), and designing dynamic curtailment protocols where necessary.

Critically, Australia's utilities experience highlights that failing to coordinate DERs forces a future in which the country could spend billions on network upgrades, whereas strategic investment now in system monitoring, DERMs, and batteries, converts the potential liability into an incontrovertible asset.

New Orleans has a rare opportunity to get ahead of these challenges – years before U.S. grids could experience anything like Australia’s rooftop experience. By motivating battery adoption alongside rooftop solar today, the city can proactively address future grid management needs before penetration levels portend - in the opinion of the utility or the regulator - to become disruptive. Deploying batteries now ensures that rooftop solar systems are not just exporting uncontrolled power, but are dynamically supporting grid reliability, providing dispatchable capacity, and flattening load curves. Building a smarter, more flexible grid through distributed energy and storage is not a cost shift—it is the intelligent modernization of the system that will save money, improve resilience, and deliver the clean, reliable electricity future that New Orleanians deserve.

Some Light Reading:

1. Ahmad Faruqui, Are California’s electricity prices rising because customers are installing solar panels?, pv magazine USA (Nov. 8, 2024).

2. Luminary Strategies, New Study from Australian Utilities Explains How to Save Consumers Billions via Integrated Distribution System Planning with DERs, LinkedIn (Aug. 8, 2024).

3. U.S. Department of Energy, Solar Futures Study (2021).

4. Lawrence Berkeley National Laboratory, Tracking the Sun Report (2023).

5. Australian Energy Networks Association, The Time is Now: Getting Smarter with the Grid (2024).